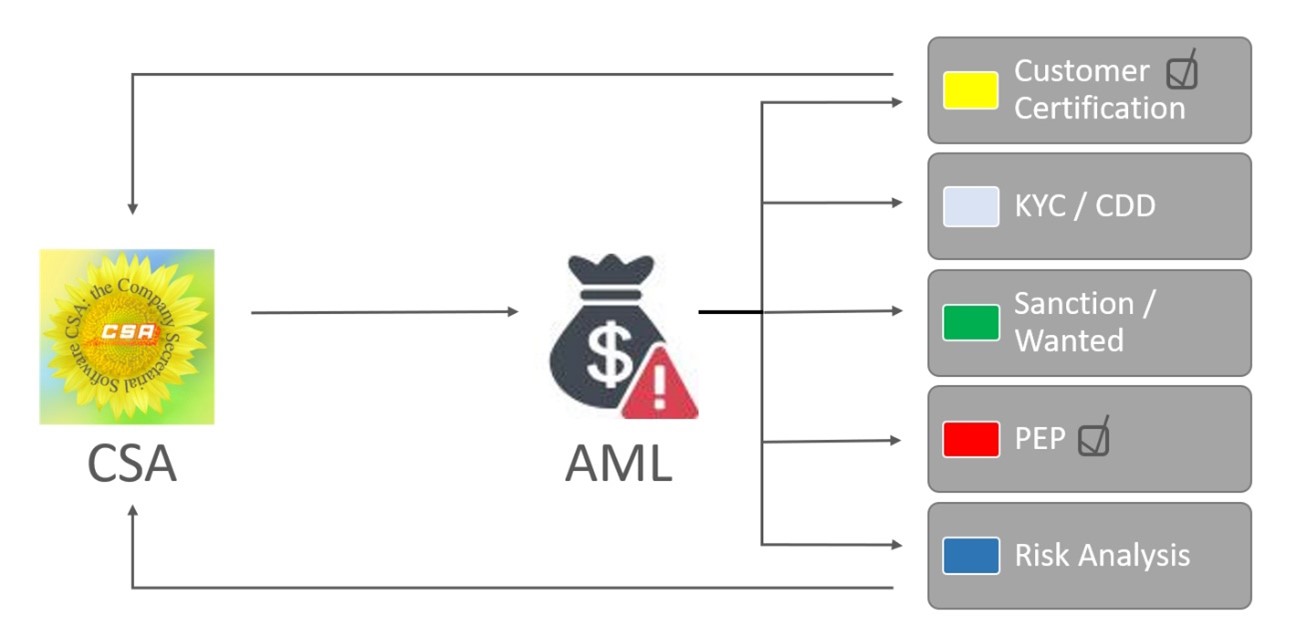

The Registrar of Companies has issued the “Guideline on Compliance of Anti-Money Laundering and Counter-Terrorist Financing Requirements for Trust or Company Service Provider” under sec.7 of the above Ordinance.

· Using CSA data to print out Information Form ready for the client’s confirmation and signatures.

· Transferring client current status information as the basis for KYC, CDD, and Risk evaluations.

· Using CSA Client Master File and Entity Master File (including corporate entities) for weekly or monthly sanction checks by batch, no need to key in any name in question again each time.

Conceptual Model

Prepare and print out the Information Form for clients for confirmation and signature.

Only need to do one set of KYC and Risk-based Approach CDD for each Entity.

And the resulting information or record will, at the same time, be applied to all related companies that the Entity belongs to.

Based on the most current client information as well as bank records, the compliance officer can fill out questionnaires for internal use with ease.

The system would automatically check every Entity (individual or corporate) against the most up-to-date sanction list and record any findings.

The system will provide relevant lists to check for persons that are being wanted by law enforcement agencies including Interpol.

The system would list all current Entities with the Client, and cross-check against previous records and data fields of “Political Affiliation” in CSA.

If it is determined that a particular person is being classified as a PEP (domestic or non-Hong Kong), then the information will show on CSA for ready reference.

The system would examine the entity’s background information and its relationship to come up with a detailed analysis together with the flow charts to disclose any beneficial interest and ultimate control.