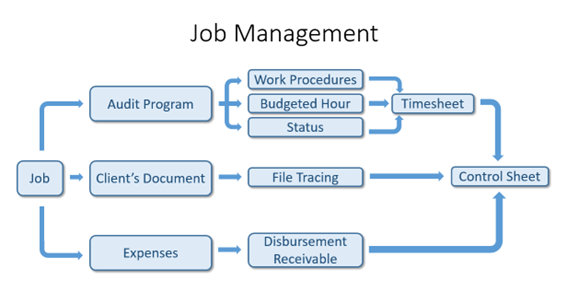

Job Assignment Management

CPAnywhere is designed with professionals in mind.

Professionals control their practice with Job Assignments.

Therefore, you need a good system to manage those Jobs.

A good job management system should consist of:

- Predefined work procedures for different types of Jobs.

- Safeguarding your client’s source documents.

- Keeping track of all disbursements and getting paid.

Managing different Job Assignments for different staff and different client is a time-consuming activity. CPAnywhere makes work done faster and more efficiently by offering the following features to professionals:

User-defined Work Procedures for different types of Jobs

For financial examination, we called those Work Procedures “Audit Programs”. For others, we simply called them “Work Procedures”.

Document Management System

We have online file storage for each client, especially for permanent files. Also, we have a function called File Tracing to let you know where the source document is last located. Moreover, we have the File Storage function to record working files in your warehouse.

Disbursement Receivable System

It is important to record all of your disbursements and not to forget to bill your clients. By setting up this system, you can rest assured that all of your disbursements will get paid during the automatic billing cycle or through individual invoicing.

One View Worth a Thousand Words

We are fortunate to have an enthusiastic CPAnywhere user (himself a French lawyer with business in Hong Kong) to share with us his brilliant way to see everything about a Job Assignment’s status. He initiated the idea and we made it happen. Now, by printing out a “Job Assignment Control Sheet”, you can see every single detail about the billing and settlement of a Job.

Automatically Generated Job ID

The system pre-defined the composition of a Job ID in a meaningful way for easy identification: Client ID + Service Division + Billing Code + Deadline It looks like very long but it does serve its practical purpose. First of all, it is easier to do the sorting. If you want to know how many Jobs belong to US tax preparation and their deadlines, you can quickly sort out the results using an Excel worksheet or through the program. Actually, the most important thing is to know the deadlines for each Job.

Time Code with Task Instructions

The purpose of an audit program is to make sure that all necessary procedures have been performed and signed off by a superior. To help to achieve this goal, we have designed the Time Code as follows: Billing Code + Work Procedure where Billing Code is the combination of: Service Division + Service Item (e.g. Tax Division + US Corporate Tax Preparation) Work Procedure is the type of work that needs to be performed. This can be expressed in a simple and straightforward way like “Holding Client Meeting” or “Sending Out Bank Confirmation”. If you want it to be very specific, you can put the whole Audit Program into the Work Procedure to guide the auditors on what needs to be done.

Better Control with Job Status

A carefully designed Job Status helps to know how much has been performed and what is the next level of work. For example, a simple Job Status for tax return preparation can be: 1. Pending 2. Work-in-Progress 3. Signing 4. Final Check 5. Send to Authorities